Categories

February 11, 2013

GRIT Sneak Peek: The Market Research Firm of the Future

What are the research techniques and key selling points of the market research firm of the future?

0

Editor’s Note: The next wave of the GRIT report is scheduled to be released early next Month to loosely coincide with the annual ARF re:Think event and our second annual GRIT Party (register for free here: http://thegritparty.eventbrite.com/#). As always We’ll be covering a wide range of topics of importance to the evolving MR industry, with multiple authors contributing to the report. As a bit of a teaser to the release today we’re releasing the section on the “Market Research Firm of the Future” that Todd Powers, EVP – Primary Research at the Advertising Research Foundation tackled.

Our findings are consistent with our data on technology and methodological adoption that we released previously, but the real eye opener here is that since this question was positioned in more of a strategic planning context that presumably GRIT respondents are now embracing these ideas as central top their long term success, not simply as the “flavor of the month” which some have suspected. Until the next wave of new disruption occurs, it is safe to assume that the next few years will be driven by these approaches vs. traditional methods and that transition period is well underway.

By Todd Powers

The 2013 GRIT survey asked respondents to think about how they might “Create their own new research company.” What are the research techniques they would choose as specialty areas? And what are the “Key selling points” they would select in order to promote the firm?

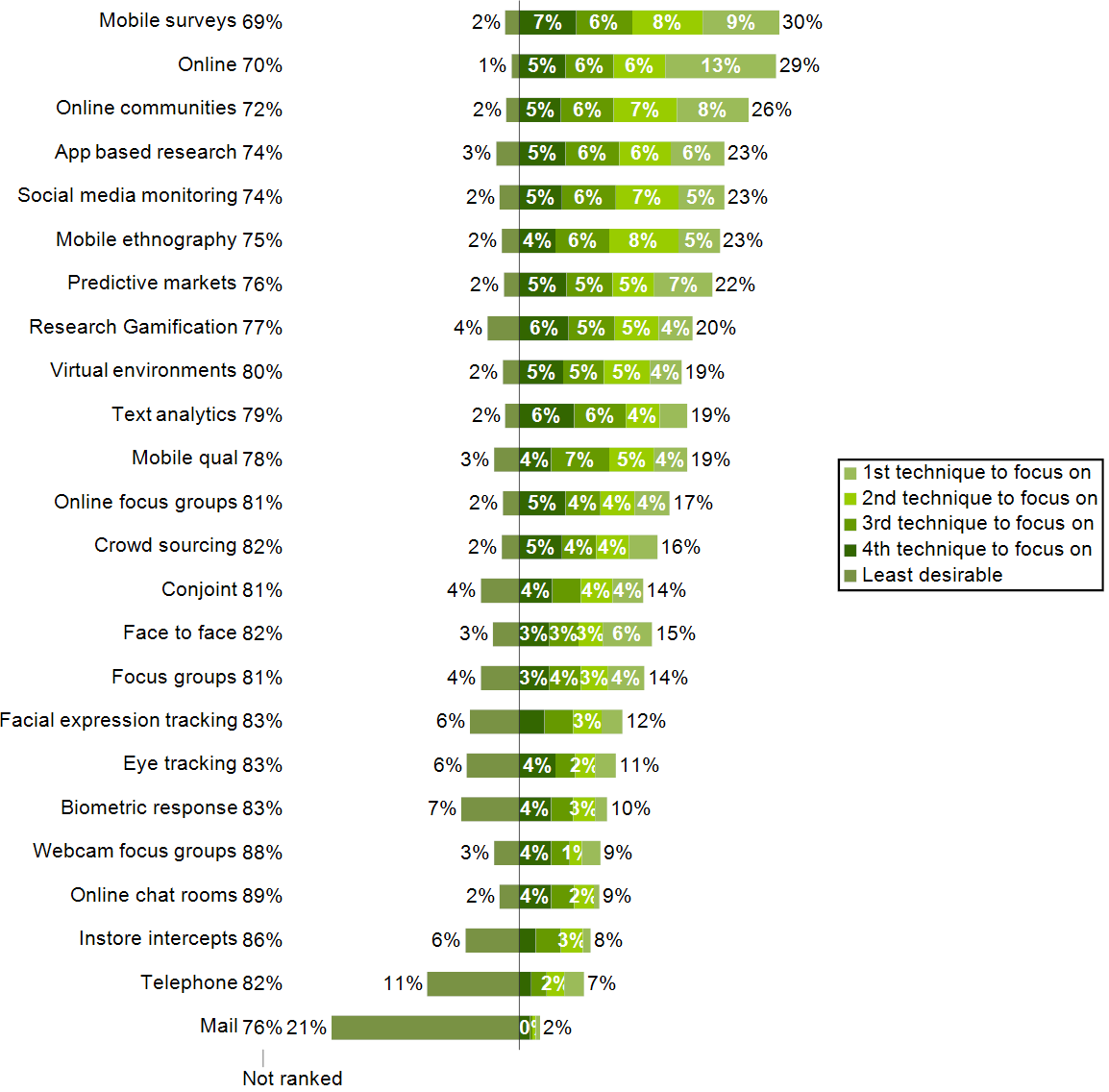

The graphic below shows the techniques selected as focal points for these hypothetical new research companies. Respondents could select up to four different areas of specialty. Responses are sorted by total combined selections (1st + 2nd + 3rd + 4th choices).

The top three areas of interest for these new research companies were fairly consistent. First, many respondents selected one or more techniques that incorporated mobile capabilities. These included mobile surveys, app-based research, mobile ethnographies, and mobile qualitative. Given the rapid adoption of mobile devices (smartphones and tablets, in particular), it is not surprising to see that researchers expect substantial demand for MR services on these platforms.

Second, we see a strong contingent of general online techniques suggested as appropriate for the research firm of the future. Included in this group are online [overall], online communities, social media monitoring, and online focus groups. These choices reflect the ongoing trend to online methods, which often offer relatively fast and inexpensive means for collecting information.

And the third set of techniques emerging as top contenders for newly-created research firms can be classified as completely new or novel data collection and analytical approaches in the industry. These include predictive markets, research gamification, virtual environments, text analytics and crowd sourcing. Presumably, these would give our newly-created firms unique value propositions to differentiate themselves in the competitive landscape.

Traditional research techniques (e.g., focus groups, telephone, and instore intercepts) sorted near the bottom of the list. This was also the case for neuro-based methods, including facial expression tracking, eye tracking, and biometric response.

Research techniques selected for inclusion in the MR firm of the future did not differ dramatically by type of respondent (supplier vs. client). In fact, there were only two techniques selected by 5% or more of one group as a “1st technique” to focus on. More suppliers (14%) selected “online” as a first technique than clients (8%). And conversely, more clients (9%) selected “text analytics” than suppliers (2%).

After identifying the techniques that they might include in their future research firms, GRIT survey respondents selected up to 3 selling points for this new company from among a list of 25 possible candidates. The list of selling points and associated selections are shown here.

What is particularly interesting about this list is the set of four selling points that bubbled to the top of the list.

“Listens well and understands client’s needs,” the top-ranked selling point, is definitely a service-related selling perspective. The next, “high quality analysis,” reflects the general capabilities and qualifications of the firm. The third-ranked item, “offers unique methodology or approach,” is a differentiating selling point. And the fourth, “consultation on best practices and methodology,” positions the new firm as an advisor/consultant, offering much more than simple data collection and analysis. Taken together, these selling points suggest a solid, well-rounded company, but one that is also focused on new and emerging techniques that will help their clients thrive.

Disclaimer

The views, opinions, data, and methodologies expressed above are those of the contributor(s) and do not necessarily reflect or represent the official policies, positions, or beliefs of Greenbook.

Comments

Comments are moderated to ensure respect towards the author and to prevent spam or self-promotion. Your comment may be edited, rejected, or approved based on these criteria. By commenting, you accept these terms and take responsibility for your contributions.

More from Todd Powers

Insights Industry News

On Technology & Human Nature (And What It Means For Marketing Insights)

Figuring out the fundamental drivers of markets, and maintaining a focus on delivering those needs, is a cornerstone of marketing strategy.

A Conversion Story Of A Cognitive Researcher To An Emotional Researcher

If you are like me, you have probably avoided the whole question of emotions in your market research career.

ARTICLES

Top in Quantitative Research

Research Methodologies

Moving Away from a Narcissistic Market Research Model

Why are we still measuring brand loyalty? It isn’t something that naturally comes up with consumers, who rarely think about brand first, if at all. Ma...

Sign Up for

Updates

Get content that matters, written by top insights industry experts, delivered right to your inbox.

67k+ subscribers