Categories

Research Methodologies

November 23, 2015

“What the Hell is an Insight?”, As Per Robert P. Moran

My favorite presentation from the MRA’s Corporate Researcher Conference was “What the Hell is an Insight?” by Robert P. Moran.

0

My absolute favorite presentation from the Marketing Research Association’s Corporate Researcher Conference was “What the Hell is an Insight?” by Robert P. Moran (@robertpmoran) of Brunswick Insight.

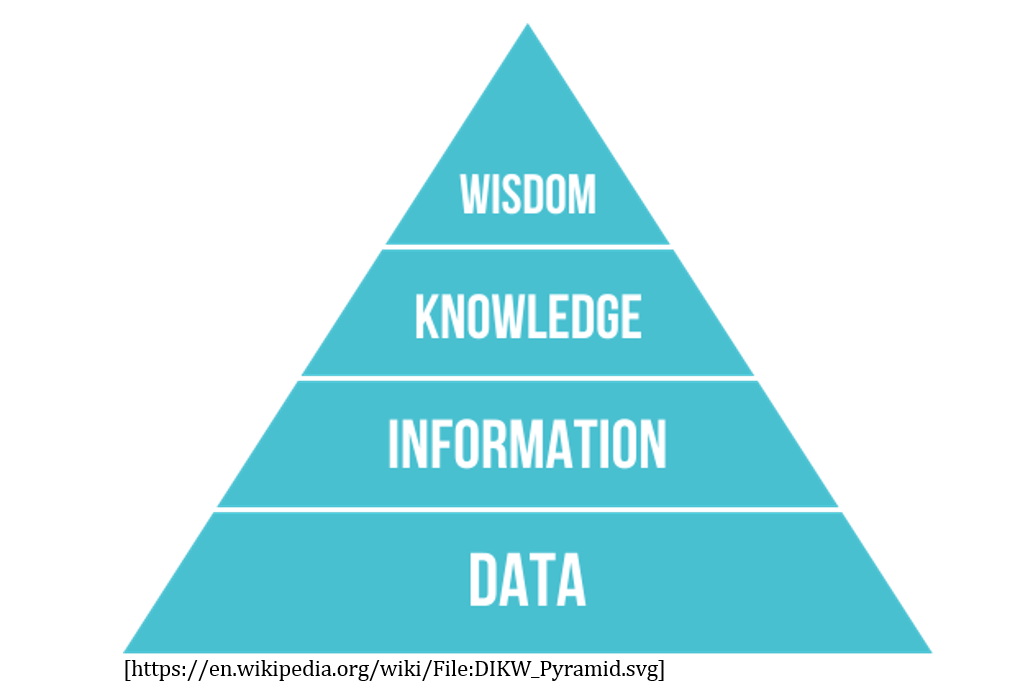

He referenced the classic information hierarchy and asked, “What is the research industry’s product?”

Too often, researchers have thought of themselves as providers of data. “But what do you call a product that is priced by volume?” Robert asked.

A commodity.

So we’ve limited ourselves to something with the value of cotton, or grain, or metal ingots.

Mike Cooke of GfK, at the 2009 ESOMAR Annual Congress, said, “As an industry, we’re often criticized for our lack of insight and an over-reliance on an industrialized view of research.”

But Robert was forgiving of our old business paradigm, arguing that inventing market research in the industrial era made it hard to pattern ourselves after anything but an industrial model. So it is no surprise that in the first era of mass markets, mass advertising, and mass production, researchers would build “data production factories.”

Yet the Industrial Age model doesn’t work in the “Dream Age” (a term coined by Rolf Jensen in Dream Society). “Market research was born when information was scarce,” Robert said. “Information is now super-abundant.”

Not only is information super-abundant, but complex practices are becoming automated. As Cory Doctorow wrote, “Pick something that’s difficult, complicated, and expensive for people to do, then imagine that thing becoming easy, simple, and inexpensive…. That’s what’s happening today.”

In a world of information abundance, we need to move up the hierarchy to knowledge and wisdom. We need to sift and synthesize the many different sources of data. We need to move beyond research being “some thing you produce” to research resulting from synthesis.

Robert then loaded us into Peabody and Sherman’s WABAC Machine and took us back to the days of the Library of Alexandria. When the Library was founded, papyrus – native to northern Africa – was the dominant source for recording information, on papyrus scrolls. The Library came to monopolize these, even taking scrolls from all the ships that put into the port of Alexandria. For the Ptolemaic dynasty that ruled Egypt, if you controlled the data (the scrolls), you controlled the information, knowledge, and wisdom. It was an ancient instance of the strategy of information scarcity. The Library was a national strategic advantage, with knowledge producing power. The dynasty even placed export controls on papyrus: “If we deny other nations our papyrus, we deny them the ability to encode information. And we win!”

With papyrus no longer exported from Egypt, rivals needed to find other methods. This led to the Pergamum developing a technology based on animal skins, which became charta pergamena (parchment). Ultimately, this led to an information explosion, and eventually, the book.

If, as an industry, we follow the Library of Alexandria strategy, we will find that it only creates new rivals. We need to “focus more on scholars and less on scrolls”, Robert said, meaning that we need to move beyond “data encoding” to “information synthesis” and “knowledge extraction.”

Robert said that research “may not be the single worst name for the industry and its product, but it is awful.” It focuses on the activity rather than the benefit and omits our role in the development of research. No wonder there has been a shift to customer insights!

“But, if we sell insights, shouldn’t we have a definition?” Too often the popular definitions today are “I know it when I see it” and the “A-HA moment.” Robert said that these are subjective definitions that immediately discount the value of the new knowledge provided by research.

In Creating Market Insight: How Firms Create Value from Market Understanding, Brian Smith and Paul Raspin argue that an insight has value, rarity, inimitability, and is actionable.

- Value – “Does this knowledge help the firm respond to market opportunities?”

- Rarity – “Is this knowledge owned only by the firm and not competitors?”

- Inimitability – “Is this information difficult for competitors to obtain?”

- Organization – “Can the firm organize in a way to exploit this knowledge?”

This provides a useful framework for identifying an insight for Robert, though he would advise against including rarity, since it is impossible to know for sure if competitors have reached the same insight.

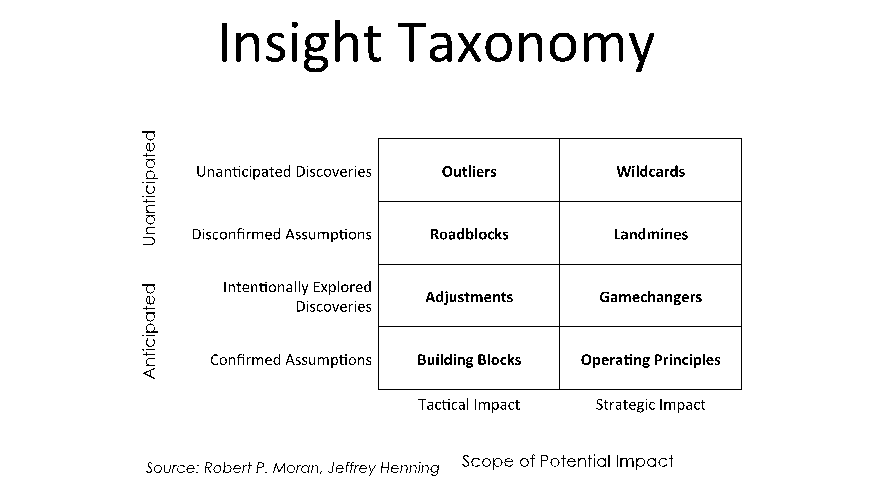

So if an insight is valuable, rare, and inimitable, what types of insights are there?

Here’s Robert’s taxonomy:

So confirmed assumptions are building blocks (if they have a tactical impact) or operating principles (if they have a strategic impact). Discoveries resulting from a systematic process can produce adjustments (think of a concept test of a tactical product line extension) or gamechangers (insight into how to meet a previously unmet need). Finally, unanticipated discoveries are outliers (if tactical) or wildcards (if strategic). The example of a wildcard that came to my mind as Robert presented was 3M’s Arthur Fry [pictured above] realizing that Dr. Spencer Silver’s accidental invention of a weak adhesive could be used as bookmarks or notes (Post-it notes).

This insight taxonomy is a powerful way to think about the types of knowledge produced by our research. The one gap I saw in it, and brought up in the Q&A, was the challenge of “disconfirmed assumptions.”

I admit my names for them are probably too dark: roadblocks (tactical impact) and landmines (strategic impact). But I think disconfirmed assumptions are important, if perilous, insights. Disconfirmed assumptions are the hardest to present. They call into question the validity of the research at all stages (from sampling to interpretation), and they are hard to convey to decision makers. Instead of presenting in an Associated Press pyramid style of most important takeaways first, I start by describing the research methodology and sample sources in detail, then slowly build the case with individual data points, drawing to a conclusion of the overturned assumption.

For one recent study, we found that the old paradigm of doing business was far more prevalent and entrenched than our disruptive, rapidly growing client believed. After cutting and re-cutting the data 3 times, the insight still persisted. It was a landmine, and blew up in our face. That’s the challenge of strategic disconfirmation.

On the tactical side, for PR surveys, we often begin by brainstorming great headlines that might come out of the research. From that, we formulate a list of hypotheses, and approach the research design by objectively testing many hypotheses. In this case, the disconfirmed assumption is more of a roadblock, a temporary obstacle, as we look to other hypotheses for our key takeaways from the research.

Robert’s insight taxonomy has changed how I think about presenting findings in my executive summaries, and has helped me realize the different communications challenges that emerge from different type of insights. I’m still pricing survey research projects as a commodity (my bad), but that’s something I need to rethink.

Robert’s taxonomy presents a powerful framework for thinking about the design and delivery of insights in our new age of information abundance.

Disclaimer

The views, opinions, data, and methodologies expressed above are those of the contributor(s) and do not necessarily reflect or represent the official policies, positions, or beliefs of Greenbook.

Comments

Comments are moderated to ensure respect towards the author and to prevent spam or self-promotion. Your comment may be edited, rejected, or approved based on these criteria. By commenting, you accept these terms and take responsibility for your contributions.

More from Jeffrey Henning

Research Methodologies

A Festivus for the Rest of Us Respondents

Reflecting on how we can improve survey design for respondents.

Brand Strategy

Aliens vs. Dinosaurs

Given the diverse backgrounds of market researchers, there is a real need to continuously train.

Insights Industry News

Researchers and the Love of Learning

MRII’s survey on how the market research industry is doing in career satisfaction, growth opportunities, and learning preferences.

#MRX Top 10: The Rise of the Amateur, of AI, and the Death of Expertise

Jeffrey Henning details the 10 most retweeted links shared using #mrx over the last two weeks.

ARTICLES

Top in Quantitative Research

Research Methodologies

Moving Away from a Narcissistic Market Research Model

Why are we still measuring brand loyalty? It isn’t something that naturally comes up with consumers, who rarely think about brand first, if at all. Ma...

Sign Up for

Updates

Get content that matters, written by top insights industry experts, delivered right to your inbox.

67k+ subscribers